*All spreads are generated from data between 01/11/2023 and 30/11/2023

^Other fees and charges apply.。

- info@springgoldmarket.com

- admin@springgoldmarket.com

- Suite 5, Level 23, 25 Martin Place, Sydney NSW 2000 Australia

| Symbol | Description | Min Spread |

|---|---|---|

| EURUSD | Euro vs US Dollar | 0 |

| GBPUSD | Great Britain Pound vs US Dollar | 0 |

| USDJPY | US Dollar vs Japanese Yen | 0 |

| AUDUSD | Australian Dollar vs US Dollar | 0 |

| USDCAD | US Dollar vs Canadian Dollar | 0.10 |

| USDCHF | US Dollar vs Swiss Franc | 0 |

| EURGBP | Euro vs Great Britain Pound | 0.20 |

In forex, currencies are quoted in pairs. Let's take the most popular currency pair as an example, EUR/USD. The first currency (Euro in this case) is called the base currency and the second (USD) is called the quote currency. When you trade a pair you are speculating on whether the base currency (EUR) will strengthen or weaken against the quote currency (USD).

Forex prices are typically quoted to five decimal places. The most important decimal point to keep an eye on is the fourth, also known as pip. It is the number of pips we use to calculate the profit and loss.

Forex positions are traded in specific amounts called lots, which equals to 100,000 units of the base currency. It is also possible to trade in smaller amounts - mini, micro and nano lots sizes, corresponding to 10,000, 1,000 and 100 units respectively.

There are three key factors that impact the prices in the forex market.

Economic reports have a big effect on currencies. For that reason, the Economic Calendar is the trader's best friend. It includes all scheduled news events and data releases, graded by importance.

Currencies are sensitive to political uncertainty caused by events such as elections, referendums and political scandals.

Acts of God, such as tsunamis, earthquakes and hurricanes, can cause significant price volatility in the currency associated with that region.

Apart from banks, financial companies and professional traders, anybody with an interest to capitalize on daily market moves can access currency trading. Forex is often described as a decentralised global market. What that means is that there is no physical location where traders meet to buy or sell.

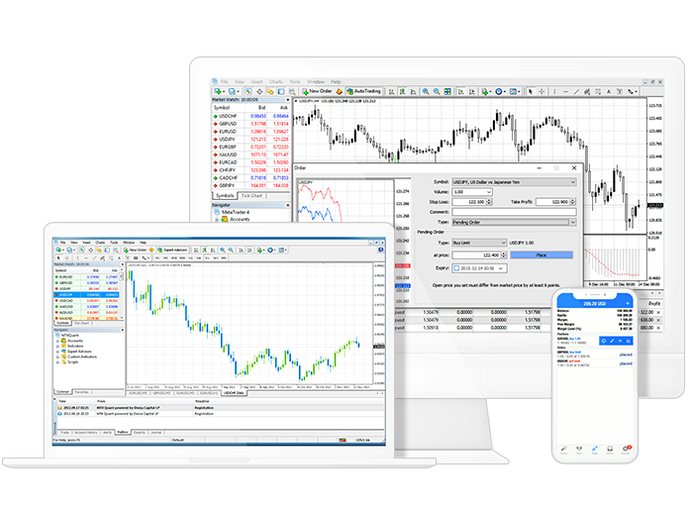

In such a market, it is technology that makes it possible for traders all over the world to deal directly with each other. Put simply, forex is a market without middlemen. All you need to participate in this fascinating and fast paced market too is a trading account with a reliable broker.

Forex trading has evolved into one of the most popular markets to trade. Here are the three key reasons why so many traders choose it.

From Sunday to Friday evening, the forex market is available for trading around the clock. This makes it ideal for traders who can only trade the markets on a part-time basis.

When trading forex online, you can control positions much larger than your capital by using leverage. This can lead both to larger gains and losses, which makes risk management a key part of every forex trading strategy. At Spring Gold, you can choose to trade currencies with leverage up to 500:1.

Unlike trading on an exchange where the contract sizes are predetermined, when trading forex online, you get to decide the size of your positions. This allows traders to start with the capital they feel comfortable with. At Spring Gold, you can start participating in the fascinating currency markets with no minimum deposit requirement for a Standard account and just £500 for a ThinkZero account.