Regardless of the account type, probably the most important consideration is the bid and ask prices displayed versus the liquidity conditions at the time of the quote. Liquidity determines how easy it is for traders to increase or decrease positions according to quotations. Good liquidity means that transactions can be completed at the next best price without moving the order book.

Due to insufficient tradable quantity provided by the market maker or liquidity provider at the specified trading price, the actual transaction is executed at a worse price, which is called "slippage", which results in traders paying larger spreads.

This happens much more often than many people think, especially for smaller brokers with zero spread models. If a trader seeks a trading volume of 0.1 lots or more, they may find that the price at which the transaction is actually completed is completely different from the price quoted on the platform.

In most cases, traders do not reconcile differences, but this slippage can add cost to a portfolio, especially for traders with larger trade sizes. This illustrates a lack of transparency in pricing and may undermine customer trust in the broker.

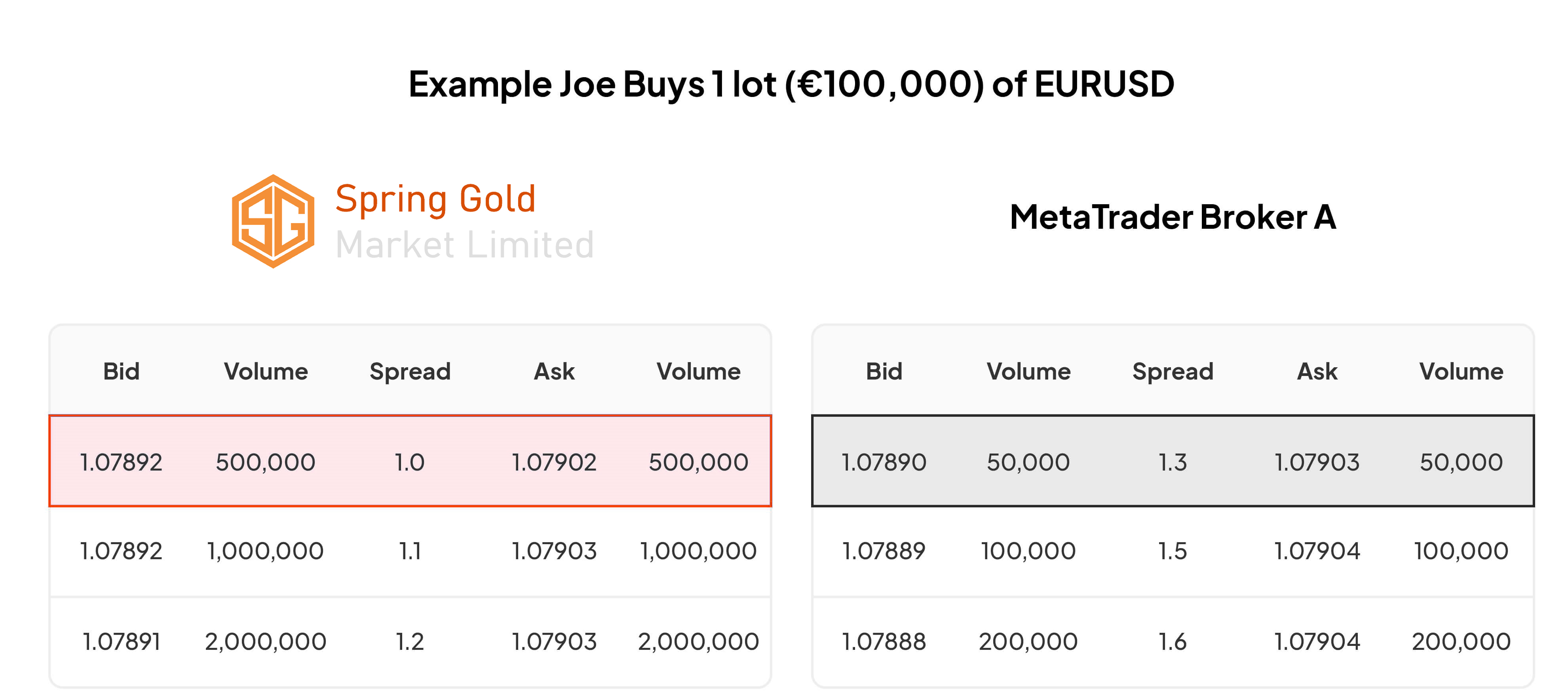

An example of the Spring Gold to explain difference

Let's say Joe wants to buy 1 lot (€100,000) of EUR/USD. With Spring Gold, Joe's order is executed at a quote of 1.07902. But for Broker A, the order was filled at a volume-weighted average price (VWAP) of 1.07904, which deviated from the quoted price. This is because Broker A has very thin liquidity and only offers a top book spread of $50,000. Since Joe buys 1 lot (€100,000), the remainder of the trade (50,000 lots) is moved to the second level of the order book, which provides 100,000 lots, and the remaining 50,000 lots are filled at this spread.

Charts are for illustrative purposes only.

On the Spring Gold platform, a 1-lot order is executed at the quoted price of 1.07902. However, on the Broker A platform, since there is not enough trading volume to satisfy the request for 1 lot, the order will be filled at the transaction weighted average price (VWAP) of 1.07904 instead of the quoted price.

While this may seem like a small difference, it highlights the fact that the price at which Joe believes he is trading and the price at which he is actually traded may differ due to changes in liquidity.

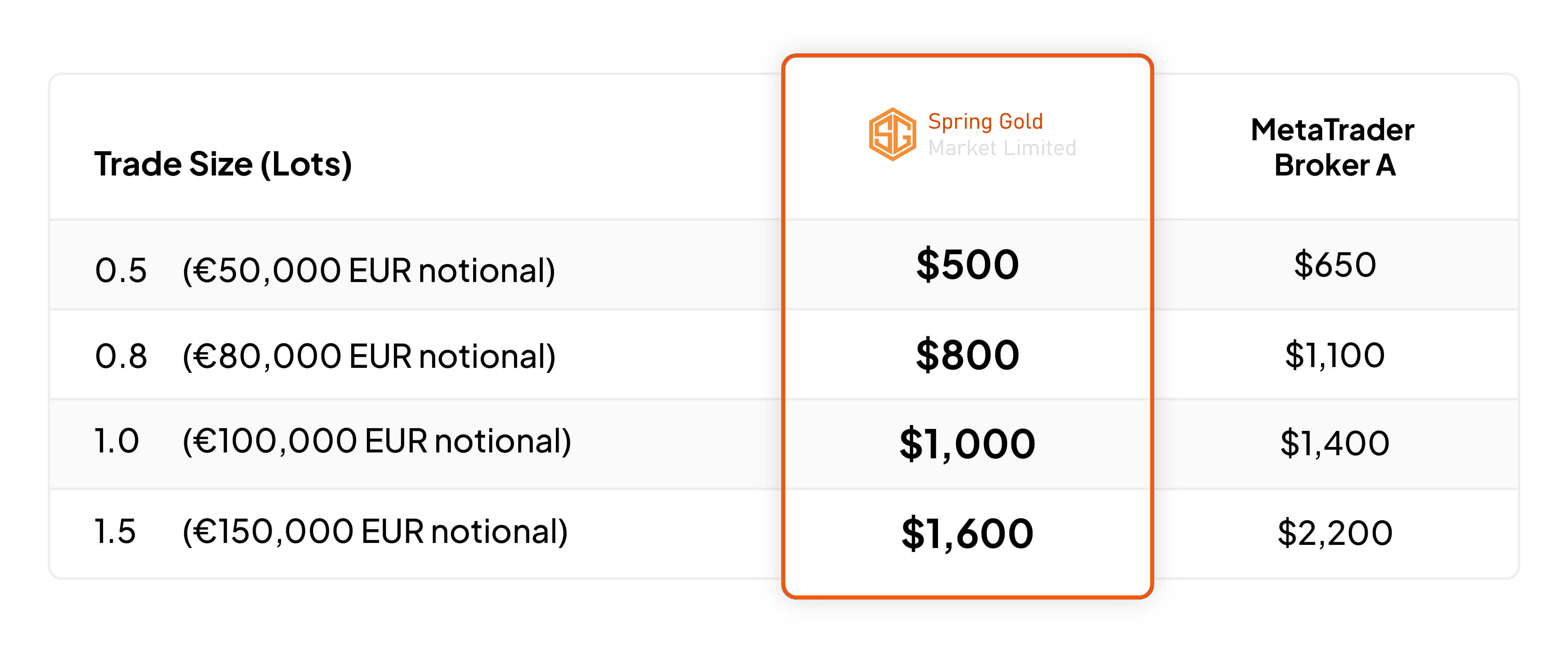

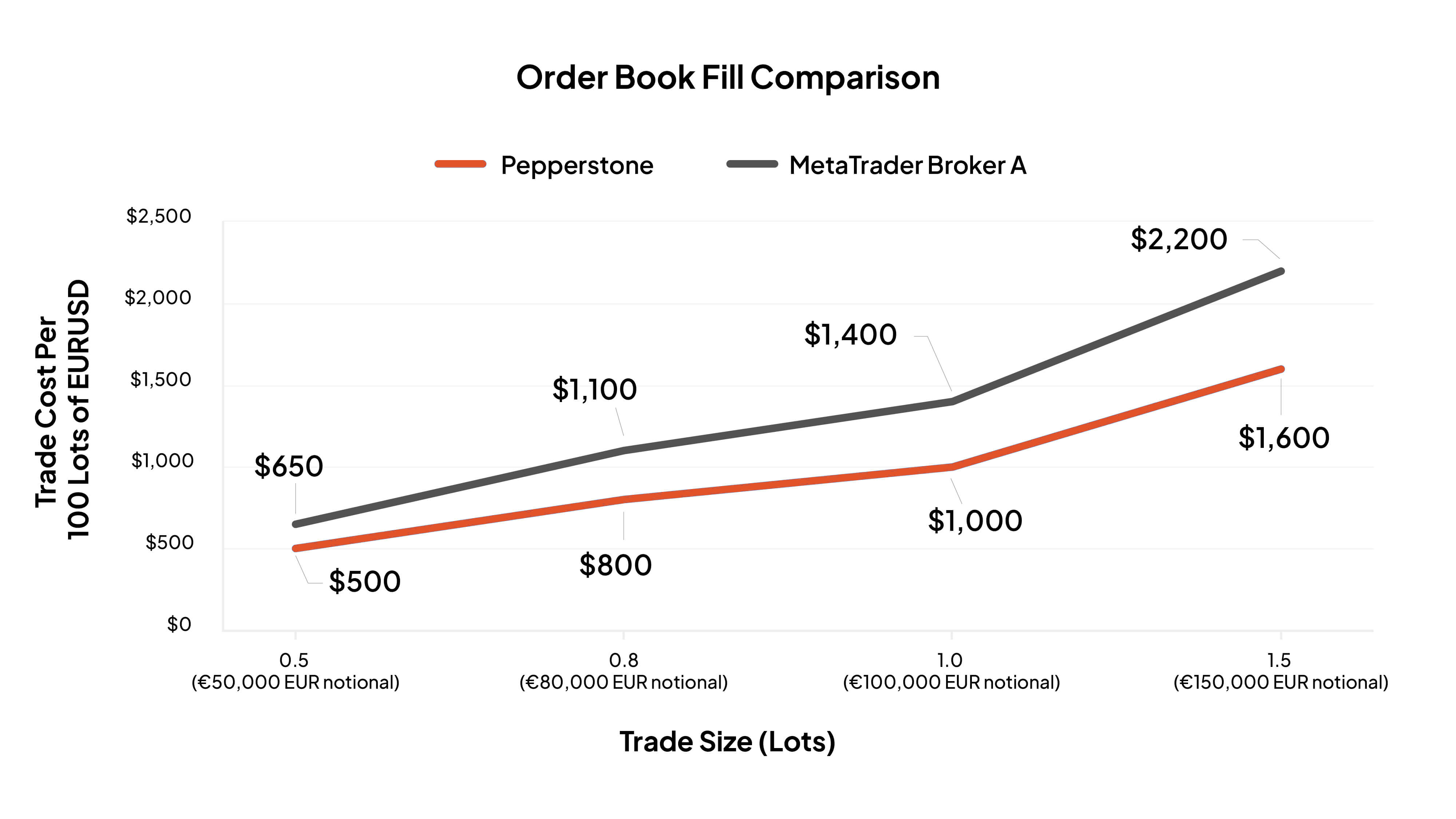

Imagine this scenario playing out over 100 trades. While prices and bid-ask spreads will change (based on this example), and liquidity will vary on each trade, if we extrapolate the parameters in this example, we can see that over time , how this situation will evolve.

Charts are for illustrative purposes only.

Charts are for illustrative purposes only.

Spring Gold has excellent liquidity (also known as top liquidity) in terms of quoted prices and is considered one of the best in the industry. Typically, if a trader wants to place a larger trade, their chances of opening and closing a position at the price quoted are greater than with many other brokers.